Future Value of Annuity Calculator, FVA Calculator

These annuities will give you an income right away, although they require a larger initial payment and might not keep pace with inflation. Annuities are ideal for people who are relatively risk-averse, are hoping to diversify their retirement plan, and want to establish a future stream of income. If you believe this describes your current investor profile, then investing in an annuity might be a good idea for you. Use our annuity calculator to calculate the future value, present value, or payout of an annuity. In the previous section, we hope we provided some insight into how a simple annuity works. However, you can apply our future value of annuity calculator to help solve some more complex financial problems.

Monet miehet kokevat haasteita intiimissä elämässään, mikä voi johtaa tunteiden ja itsetunnon heikkenemiseen. Tällaisissa tilanteissa kannattaa etsiä ratkaisuja luotettavalta apteekkisivustolta, joka tarjoaa turvallisia ja vaikuttavia vaihtoehtoja. Lisätietoja ja tuotteita voi löytää osoitteesta pillerit-suomi.com.

Income Annuity Calculator

In terms of situational analysis, the choice between these two depends largely on the payment schedule and financial goals. An Ordinary Annuity is preferable when payments are more feasible at the end of a period, such as saving from a monthly salary. Annuity Due is more suitable when early payment is possible or desirable, such as in pension plans where early receipt is beneficial for covering immediate expenses. When comparing the future values of Ordinary dependent care expenses Annuity and Annuity Due, the primary difference lies in the timing of payments and the subsequent impact on compounding. Annuity Due typically results in a higher future value compared to an Ordinary Annuity given the same terms, as each payment in Annuity Due benefits from an additional compounding period. The concept of future value plays a critical role in personal finance, especially when it comes to planning for retirement, savings, or investments.

Periodic Addition Calculation

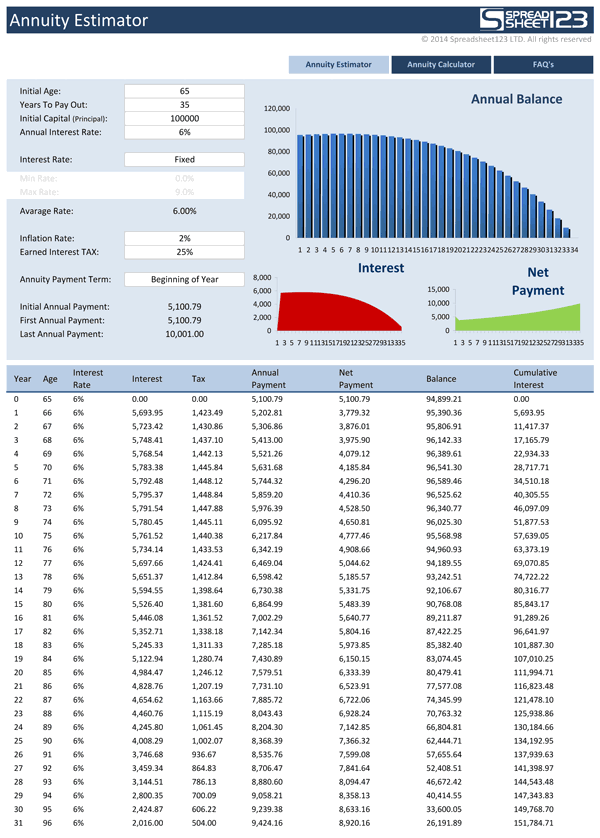

A person receiving a pension at the end of each month is an example of an Ordinary Annuity. In contrast, if the pension is received at the beginning of each month, it’s an Annuity Due. The calculator also displays a graph showing how your annuity grows over the specified period.

Total Payments

So, for example, if you plan to invest a certain amount each month or year, FV will tell you how much you will accumulate as of a future date. If you are making regular payments on a loan, the FV is useful in determining the total cost of the loan. Different annuity investments may have varying tax treatments, which can affect the net future value. It’s essential to consider these implications in the overall financial planning process to optimize tax benefits and reduce liabilities. The future value of an Ordinary Annuity is calculated by summing the compounded value of each annuity payment at the end of the specified term.

Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. Annuity.org carefully selects partners who share a common goal of educating consumers and helping them select the most appropriate product for their unique financial and lifestyle goals. Our network of advisors will never recommend products that are not right for the consumer, nor will Annuity.org. Additionally, Annuity.org operates independently of its partners and has complete editorial control over the information we publish. When we are utilizing the future value of an annuity calculator, we are going to find the detailed output of annuity. The bottom line is, the only way to make wise financial decisions is to be able to accurately weigh what you are giving up in exchange for what you are getting.

Calculating the Future Value of an Ordinary Annuity

While I do research each calculator’s subject prior to creating and upgrading them, because I don’t work in those fields on a regular basis, I eventually forget what I learned during my research. So if you have a question about the calculator’s subject, please seek out the help of someone who is an expert in the subject. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the “Data” tab, this line will list the name you gave to that data record.

The total amount that series of equal amounts would grow to after three years would be the future value of the annuity. Follow me on any of the social media sites below and be among the first to get a sneak peek at the newest and coolest calculators that are being added or updated each month. In order to receive the monthly updates, all three boxes must be checked in the Terms, Privacy Policy, and Consent section. This field should already be filled in if you are using a newer web browser with javascript turned on. If it’s not filled in, please enter the title of the calculator as listed at the top of the page.

With an ordinary variable annuity, the owner will be able to choose which securities they are indirectly invested in. Usually, this means variable annuities will pay out more when markets are thriving and less when markets are weak. Mortality and Expense Fee–This is a fee the insurance company charges for providing lifetime income and a death benefit during the accumulation phase. In general, a person purchasing an annuity at a younger age will benefit from reduced mortality fees. In most cases, it only applies to the beginning 5 to 9 years of the life of an annuity, but some plans may be subject to a surrender charge for as long as 15 to 20 years. It is possible to find annuities that don’t have surrender charges, but these likely require higher annual expenses.

- An indexed annuity, sometimes called an equity-indexed annuity, combines aspects of both fixed and variable annuities, though they are defined as a fixed annuity by legal statute.

- If you receive the annuity as a lump sum payment, that could push you into a higher tax bracket and increase your total tax bill.

- Annuities can be a valuable financial asset for retirement planning and establishing future sources of cash flow.

Below the screen, there is a keypad with numerous buttons divided into several rows. The buttons provide various financial calculations and standard calculator functions. You can calculate the present or future value for an ordinary annuity or an annuity due using the formulas shown below. These recurring or ongoing payments are technically referred to as annuities (not to be confused with the financial product called an annuity, though the two are related). Annuity.org is a licensed insurance agency in multiple states, and we have two licensed insurance agents on our staff. However, we do not sell annuities or any insurance products, nor do we receive compensation for promoting specific products.

Comentarios